In today's complex corporate landscape, a Company Secretary is more than just a compliance officer—they're your strategic ally in navigating governance excellence and regulatory harmony. At LETESE, we bring you ICSI-certified professionals who transform mandatory requirements into opportunities for growth

Navigating Growth Together:

Comprehensive Corporate Solutions

LETESE offers ICSI-certified Company Secretaries who go beyond compliance, serving as strategic partners to navigate governance and regulations, transforming requirements into growth opportunities for your business.

Company Registration

Private Ltd, Public Ltd, OPC, LLP, and foreign entities – we handle all procedures and compliance seamlessly.

Corporate Restructuring

Flawless processes for compliant, strategic restructuring solutions, mergers & acquisitions, and company winding up.

Change Services

We certify corporate changes with our proficient in-house team, simplifying the compliance for relocations, restructuring, or updates.

Corporate Compliances

Our CS experts handle compliance, filings, and audits for OPCs, LLPs, Private Ltd, and Public Ltd companies, letting you focus on growth.

Listing Compliances

Leave listing compliance, SEBI rules, IPOs, and disclosures to us—so you can focus on growth and building investor trust.

FEMA & RBI Compliances

Streamlines FEMA & RBI compliance for smooth international transactions, investments, and filings.

IPR

Protect your brand with IPR solutions—trademark, patent, copyright registration, renewals, and disputes.

Miscellaneous Services

Our in-house CS team ensures compliance, accuracy, and strategic advice, letting you focus on growth.

Retainership Services

Our retainership services handle regulations, filings, and advisory support, letting you focus on growth.

Our Streamlined Process

Transform compliance into your competitive edge with LETESE's CS services. Our experts navigate regulatory complexities, ensuring seamless governance while you concentrate on advancing your business objectives.

Initial Consultation

We assess your unique needs, from compliance to restructuring.

Documentation

Precise collection and validation of essential records.

Timely Submissions

Timely submissions through official MCA and SEBI portals.

Execution & Delivery

From AGMs to audits, we deliver with excellence.

Why Choose LETESE?

We simplify corporate compliance with precision, expertise, and seamless execution—empowering your business to stay compliant and thrive.

Strategic Governance

Expert counsel for boards on legal compliance, risk management frameworks, and decision protocols meeting statutory obligations.

Regulatory Assurance

Proactive compliance systems monitoring MCA mandates, SEBI guidelines, and FEMA provisions through continuous regulatory tracking.

Meeting Excellence

End-to-end management of statutory assemblies ensuring resolution formalization, and legally sound minute documentation processes.

Ethical Infrastructure

Whistleblower mechanisms, conflict disclosure protocols, and transparency systems fostering organizational accountability..

Adaptive Compliance

Scalable governance solutions customized to industry specifications, operational scale, and evolving business maturity levels..

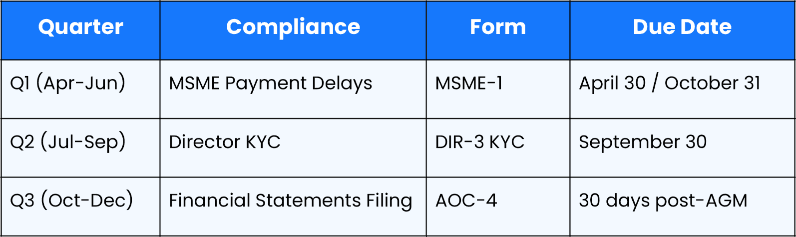

Effortlessly monitor and meet regulatory deadlines with our expert guidance.

- Annual Deadlines

Your Paperwork, Our Priority

Revitalizing your approach to regulatory paperwork with our expert form management services.

Mandatory annual filing to report foreign direct investments (FDI) and overseas direct investments (ODI) to the Reserve Bank of India (RBI), even if no new transactions occurred, provided outstanding FDI/ODI exists.